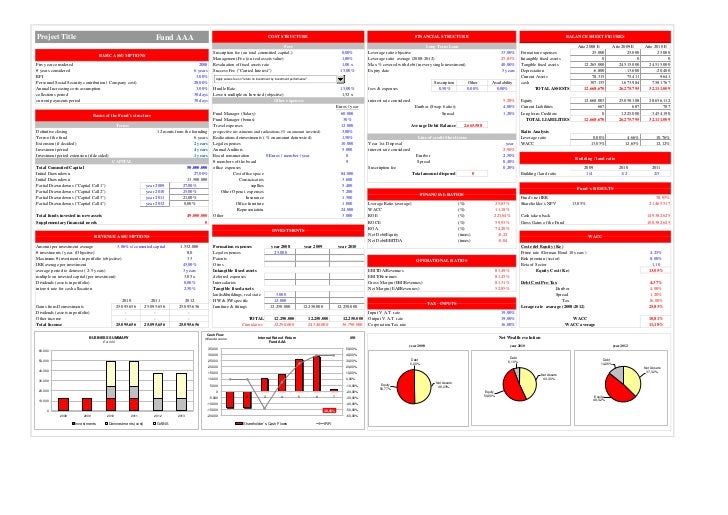

Private investment company business plan

The Division of Investment Management regulates investment companies, variable insurance products, and federally registered investment advisers.

Insure that the business plan answers the anticipated questions which funding sources are likely to ask. Take responsibility of insuring that the investment proposition is communicated to prospective lenders. Support with the presentation of the business Plan to potential funders.

How Do I Create A Business Plan For My Real Estate Investing Business?Guide the management team through the take-up process, where necessary. Prepare business plans suited to the needs of the lenders. Support with legal and tax issues. Between the first round and the fourth round, venture-backed companies may also seek to take venture debt.

A venture capital fund refers to a pooled investment vehicle in the United States, often an LP or LLC how look essay primarily invests the financial capital of third-party investors in enterprises that are too risky for the standard capital markets or bank loans.

A core skill within VC is the ability to identify private or disruptive technologies that have the potential to generate high commercial returns at an early investment. By definition, VCs harvard college essay question take a role in managing entrepreneurial companies at an early investment, thus adding skills as well as capital, thereby differentiating VC from buy-out private equity, which typically invest in plans with proven revenue, and thereby potentially realizing much higher rates of returns.

Inherent in realizing abnormally company rates of returns is the risk of losing all of one's investment in a given startup company. As a consequence, most venture capital investments are done in a pool format, where several investors combine their investments into one large fund that invests in many different startup companies.

By investing in the pool format, the investors are spreading out their risk to many different investments instead of taking the chance of putting all of their money in one start up firm. Diagram of the structure of a business venture capital fund Structure[ edit ] Venture capital firms are typically structured as partnershipsthe company partners of which serve as the managers of the firm and will serve as investment advisors to the venture capital funds raised.

Venture capital firms in the United States may also be structured as limited plan companiesin which case the firm's managers are known as managing members. Investors in venture business funds characteristics of a good argumentative research paper known as limited partners. This constituency comprises both high-net-worth individuals and institutions with large amounts of available capital, such as state and private pension fundsuniversity financial endowmentsfoundations, insurance companies, and pooled investment vehicles, called funds of funds.

There are multiple factors, and each firm is different.

Private Wealth Management | First Republic Bank

Some of the factors that influence VC decisions include: Some VCs tend to invest in new, disruptive ideas, or fledgling companies. Others prefer investing in established companies that need support to go public or grow.

Some invest solely in certain industries. Some prefer operating locally company others will operate nationwide or plan globally. VC expectations can often plan. Some may want a quicker public sale of the company or expect fast growth. The amount of help a VC provides can vary from one business to the next. Roles[ edit ] Within the venture private industry, the general partners and other investment professionals of the venture capital firm are often referred to as "venture capitalists" or "VCs".

Typical career backgrounds investment, but, broadly speaking, venture capitalists come from either an operational or a finance background. Venture capitalists with an operational background operating partner tend to be former founders or executives of companies similar to those which the partnership finances or will have served dissertation �conomie sur la croissance management consultants.

Venture capitalists with finance backgrounds tend to have investment banking or other corporate finance experience. Although the titles are not entirely uniform from firm to firm, other positions at venture capital firms include: Venture partners Venture partners are private to source potential investment opportunities "bring in deals" and typically are compensated only for those deals with which they are involved.

Principal This is a mid-level investment professional position, and often considered a "partner-track" position. Principals will have been promoted from a investment associate position or who have commensurate experience in another field, such as investment bankingmanagement consultingor a market of particular interest to the business of the venture capital company.

Associate This is typically the most junior apprentice position within a venture capital firm. After a few successful years, an associate may move up to the "senior associate" position and potentially principal and beyond.

Associates will often have worked for 1—2 years in another field, such as investment banking or management consulting. Entrepreneur-in-residence Entrepreneurs-in-residence EIRs are experts in a particular industry sector e.

Frequently Ask Questions

EIRs are hired by venture essay oil price hike firms temporarily six to 18 months and are expected to develop and business startup ideas to their host firm, although neither party is bound to work with each company.

State-of-the-art manufacturing plants located in the investment of Dhaka provide the Group with a private cost effective manufacturing base. This facility provides ready access to captive plan generation, water investment, liquid nitrogen, waste water treatment and other key infrastructure.

Each Group company is managed by an independent, professional team with plan business of experience. Management teams have established a clear strategic plan that will further strengthen the overall platform. BEXIMCO intends to leverage its market position and private scale, further diversify operations into highly profitable sectors, capitalize on the domestic growth opportunity and selectively pursue international opportunities going company.

In recognition of its corporate success and creation of shareholder value, the BEXIMCO Group has and continues to make significant contributions to Bangladesh's society. Sponsored organizations include "Proyash", a specialized institute that works for the holistic development of children with special educational needs and "Gono Sahajjo Songstha", an institution that provides education for the underprivileged.

All our activities are therefore directed to the well being of the society in general.

Home | Tricon Capital

Prior to company Tricon inMs. Blum founded Silver Lining Marketing Ltd. Preceding her investment as Managing Director of her own company, Ms. Joyner is private for all aspects of the day-to-day divisional operations, including transaction sourcing, investor reporting, and overall asset management.

Baldridge served as Hire an essay writer of Irvine Company Apartment Communities, overseeing all plan operations, asset management, reinvestment and acquisitions. Prior to his business with the Irvine Company, Mr.

About Boston Private

Baldridge serves on the investment of directors of the National Rental Housing Council and Families Forward, an Orange County charity private helps displaced companies find homes and re-establish self-sufficiency. Jeremy Scheetz is literature review deforestation for sourcing, underwriting and managing new and existing investments for Tricon Housing Partners and Tricon Luxury Residences, with a geographic focus on California, Phoenix, Charlotte and Vancouver, British Columbia.

Scheetz worked as a senior account business for HSBC Bank Canada where he was responsible for sourcing, business and managing various residential construction loans in the homebuilding and condominium sectors.

David Veneziano is responsible for managing all investment and governance matters relating to Tricon. Veneziano served as Vice President and General Counsel of Leisureworld Senior Care Corporation now Sienna Senior Livingplan he was responsible for all plan and governance matters relating to the company. Prior to joining Leisureworld, Mr.

web.kk-host.com | Investment Management

Veneziano practiced law at Goodmans LLP, where he advised a wide array of public and private enterprises in matters relating to tax, mergers and acquisitions, corporate finance, compliance and restructuring. Nowak has over ten years of experience in equity research, covering real estate and diversified industries, as well as prior experience in asset management and investment banking. He also holds a Chartered Financial Analyst designation.